Test Results: Long-Term Leveraged ETF Investments

Most investment advisors and mainstream media advise against holding leveraged ETFs long-term. There is no reason you can't, and there are large benefits to doing so.

Many financial advisors (including the funds themselves and financial news sources) advise investors to not hold leveraged ETFs (LETFs) long-term (e.g. SOXL, TQQQ, FNGU, USD). Due to the unexpected 2022 downturn I held these investments for 1-3 years, and this article has been written over the course of several years. Here is the outcome.

Spoiler: Yes, you can hold LETFs for longer periods and get dramatic gains, particularly if you buy them during bear markets - but there are downsides. Detailed discussion is at the end of this article.

Note: the Seeking Alpha editorial board refused to publish this because “leveraged ETFs are too controversial” and they do not see any benefits to scientifically testing investing hypotheses with real money. When major market players refuse to discuss certain topics, I see an opportunity to test it myself and potentially profit - regardless of existing dogma. Stock investing is one of the areas with the greatest predilection for hypotheses and predictions, and the least for testing and validation, of most topics I can think of.

The following outlines a series of investments in different leveraged ETFs. For each, the buy and sell dates, profit or loss, as well as a summary of what occurred is shown. These were all real investments with real money, and they were used to test various investing hypotheses at the time of the investment. I have not cherry-picked only the successes - all investments regardless of returns are shown for this time period.

Experiments: SOXL

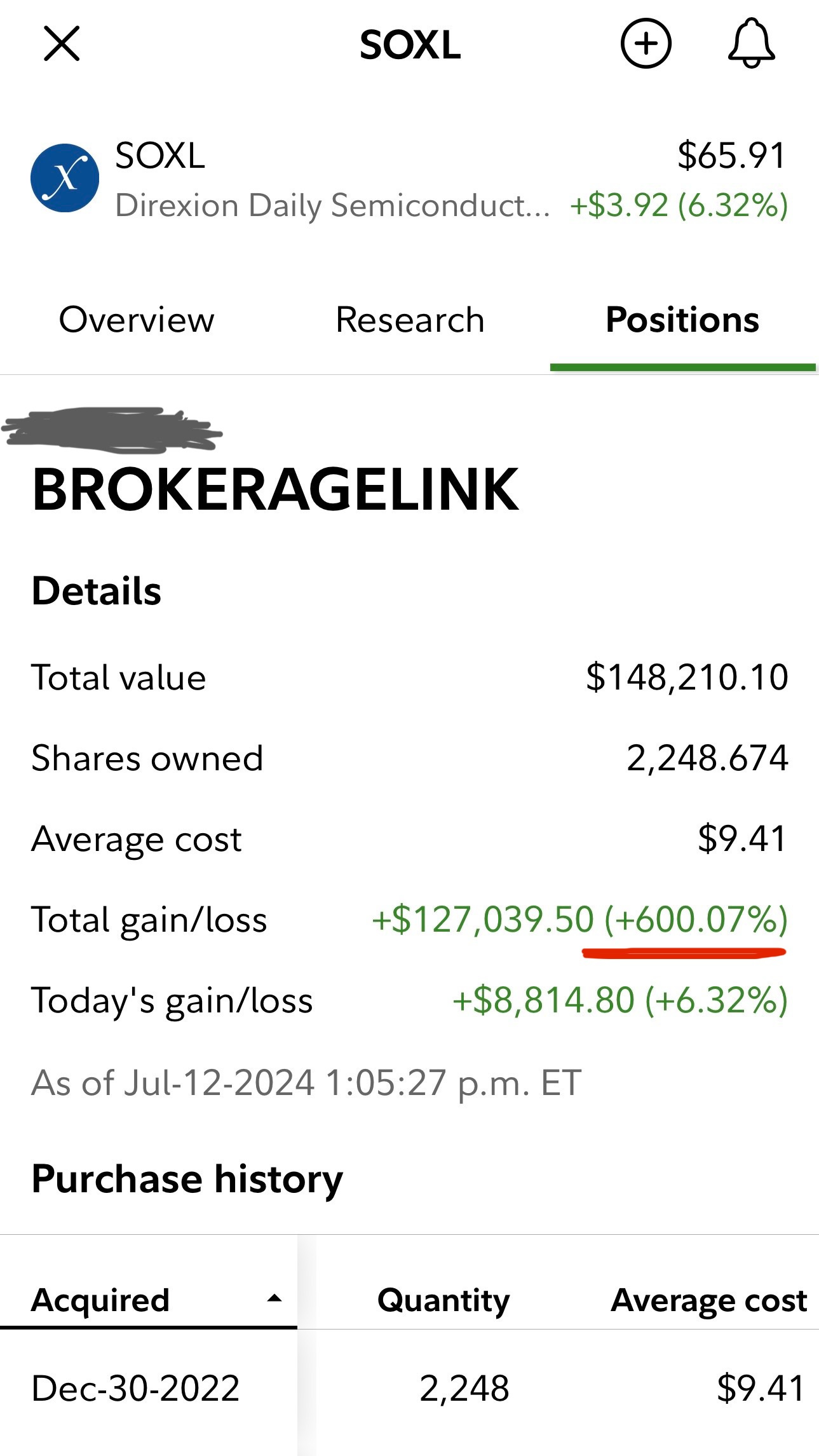

Brokerage #1: (retirement-1)

Date purchased: DEC-30–2022

Date sold: JUL-12-2024 (L1)

Purchase price: $9.41

Sell price: $70.00 (L1)

Profit: 644% (L1)

Duration: ~1.5 yrs (L1)

Summary: Lot 1 (L1) yielded a very healthy return, and I am waiting for a slightly better return on L2. L2 Test is not complete yet - check back later.

Brokerage #2: (retirement-2)

Date purchased: FEB-16–2022

Date sold:

Purchase price: $16.32

Sell price:

Profit:

Duration:

Summary: This test is not complete yet. Check back later.

Brokerage #3: (non-retirement-1)

Dates purchased: Multiple: DEC 30, 2021 — JAN 24, 2022

Date sold: JUN 12, 2024 (L1)

Purchase price: Average: $55.62

Sell price: $59.34 (L1)

Profit: 6.7% (L1)

Duration: ~2.5 yrs (L1)

Summary: This involved multiple purchases of SOXL as part of a short-term strategy which resulted in a high buy-in just prior to a major market drop. It gives a good example of a “worst-case scenario” and 2+ year hold time. It still did not result in a loss, but there was less profit. I sold some a bit earlier than needed for personal financial stability.

Dates purchase: JUL 23-30, 2024

Date sold: AUG 23, 2024

Purchase price: Average: $119.11 (2 lots)

Sell price: $130.48

Profit: 9.53%

Duration: ~1 mo

Summary: In a rising market it is pretty easy to buy low sell high. Do not get greedy with this however, because if you invest too much in this strategy you will get caught when the next bear market happens (as I did in the example above.)

Brokerage #4: (non-retirement)

Date purchased: JAN-17–2023

Date sold: JUL-11-2024

Purchase price: $12.98

Sell price: $70.00

Profit: 439%

Duration: 1.5 yrs

Summary: This was some extra cash I scraped together and put into SOXL when the market was low.

Experiments: TQQQ

Brokerage #1: (retirement-1)

Date purchased: DEC-30–2022

Date sold:

Purchase price: $17.35

Sell price: $81.81

% Profit: ~389%

Duration: 2 yrs

Summary: See below.

Brokerage #2: (retirement-2)

Date purchased: DEC-30–2022

Date sold: NOV-7-2024

Purchase price: $16.74

Sell price: $81.90

% Profit: ~389%

Duration: 2 yrs

Summary: TQQQ didn’t come up as fast as some other investments, but it still has a healthy return which is close to 200%/yr when annualized.

Experiments: FNGU

Brokerage #3: (non-retirement)

Date purchased: NOV-15–2021

Date sold: JUN 12, 2024

Purchase price: $394.80 (split-adjusted)

Sell price: 434.00

% Profit: 9.9%

Duration: ~2.5 yrs

Summary: Technically FNGU is a leveraged ETN, which probably increases risk. A reverse-split occurred while I held the stock, which is not ideal and scary. This was a failed experiment in my view, and I don’t intend to invest in FNGU again. Note that even in this near-worst-case-scenario, using a leveraged ETN, no money was lost.

Experiments: USD

Brokerage #5: (non-retirement, friend)

Date purchased: NOV-15–2021

Date sold:

Purchase price: $394.80 (split-adjusted)

Sell price:

% Profit:

Duration:

Summary: This test is not complete yet. Check back later. A friend of mine invested in USD at the same time I was running experiments with other leveraged funds. This is her results. USD has a history of returning to its record-high price sooner than other funds and I plan to purchase more of it in the future.

Brokerage #3: (non-retirement)

Date purchased: AUG-23–2024

Date sold: SEP 25, 2024

Purchase price: 116.13 (split-adjusted, cost-basis of 2 lots)

Sell price: $123.33

% Profit: 6%

Duration: 1 mo

Summary: This was a short-term hold strategy.

Retirement Accounts

Many of these investments were made in retirement funds, which sometimes have the option of letting you manually control investments (you may need to request access from your account manager). The advantage of doing your investing inside retirement accounts, is that you don’t immediately pay taxes on your profits whenever you sell a position (like you do outside a retirement account.) However, in an IRA you will pay taxes after you retire and start withdrawals. In a Roth (IRA or 401k) you pay your taxes initially, but don’t pay any when you withdraw your accumulated profits later. All of my retirement accounts are Roth for this reason.

Concluding Thoughts

End result: No money was lost in any of the experiments, including those I concluded were failures. Money would have been lost if I had panicked and sold early, but I waited until the market (finally, after much patience) recovered.

Most of the tests with lower-percentage returns had smaller amounts of money initially invested. Across the collective test investment, the average total return will probably be around 450% after the final tests exit. This would have been higher, but I made some mistakes (see below).Prior work: This is not the first time I have held leveraged funds for long periods of time with large resulting gains. See details on these prior investments here and here. This has been tested multiple times in different market conditions over multiple tax years.

Testing: The vast majority of investing articles never actually test their predictions using real money. Most of them involve theoretical predictions, with no precise dates, which no one goes back to verify after they have expired. Never trust a prediction unless it has been empirically tested and validated in past experiments. Then go back to first principles to validate their logic, and then test the theory with small amounts of your own money first, before doubling down.

Delay: Leveraged ETFs tend to be delayed, and they tend to exaggerate their base investments. Around FEB 2024 the SP500 and Nasdaq hit new all-time-highs, but leveraged ETFS based on portions of them (such as TQQQ and SOXL) took much longer to reach their own new highs. This is partially due to the loans the LETFs have to constantly pay for. It is also due to the fact that the prior all-time-high was also an exaggerated high. Consequently, it takes longer for the market to build back to that extreme level. So when I say “long-term LETF investments” I really mean it — it will be a longer hold than the non-leveraged equivalent. Do not underestimate your self-doubt when the overall market has reached new highs and your leveraged investment is still lagging by 20% - you have been warned.

Total returns: Note that it is important to look at annualized returns, not just total returns. When you unexpectedly have to hold an investment for 3 years instead of 1 month, you need to divide your return by 3 to see how much you earned each year (if you sell in 1-month you can multiply by 12 to get your theoretical annual). Some of the returns above are still very high, but they aren’t as enormous as they seem at first glance, due to the hold time.

My mistake: In the above experiments I used too much leverage (margin/loans) and got stuck in existing investments that were too large and too high, as the market dropped in early 2021. I had to hold those until 2024. This resulted in some sleepless nights and having to repeatedly scrounge money from other accounts to pay off the margin call. Do not get yourself in this position. Read that last sentence twice. I would suggest using very small amounts of leverage, keeping large emergency funds, and always consider the possibility of a 5-year bear market in your overall strategy. In other words: “Listen to your spouse.”

Things to avoid: It is worth mentioning that there are many suboptimal ways to use LETFs. These include: buying at a peak, holding an LETF after a peak, and holding across multiple bull/bear cycles. Very large drawdowns, margin calls, and stress are likely outcomes in those scenarios. However, it is theoretically possible to wait them out (as I did in the above examples). You need to be patient and have safety nets in place to use.

△ Photo credit: AI-generated by Black Forest Labs

Disclaimer: I do not hold any financial degrees or certifications. I am not a tax advisor. Your investment decisions are your own, and it is best to test strategies with small amounts of money first, preferably after extensive back-testing. Question the dogma and discover the facts for yourself.

I totally agree that you can use leveraged ETFs for longer term, but you need to have a strategy when to get out otherwise you can get burned. I use 100% UPRO and can sleep at night since I have a strategy that avoids downturns. Long term results come in around 25% annualized.